43+ how does the fed rate cut affect mortgages

Web Fed rate cuts are designed to lower interest rates throughout the economy and make it cheaper to borrow money. But theres a very.

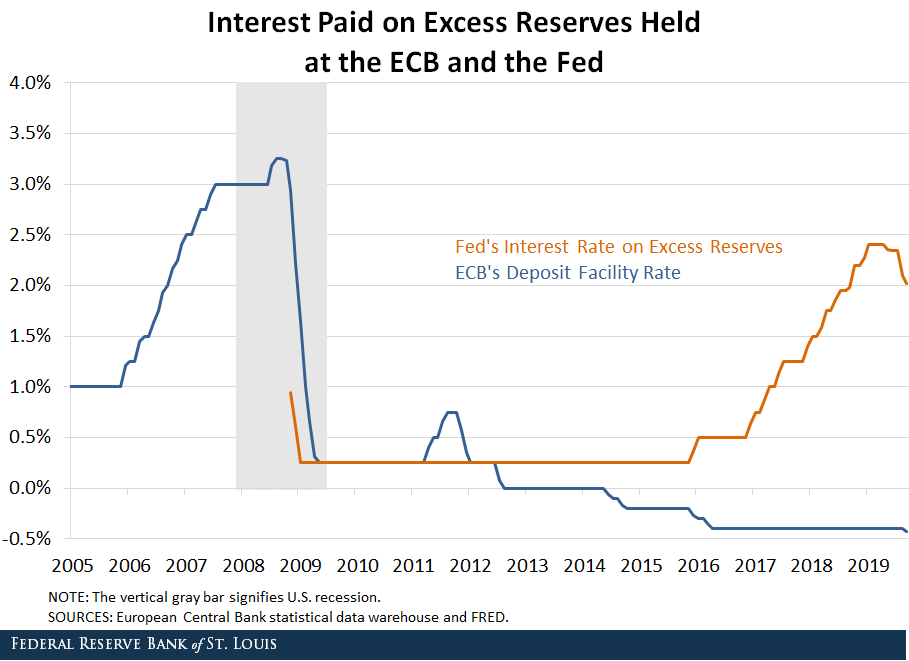

A Primer On Negative Interest Rates St Louis Fed

A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly.

. Web This caused mortgage rates to marginally move back up prior to the announcement. The FOMC controls one rate called Federal Funds. Web The Fed only changes one rate And that rate doesnt have much at all to do with your mortgage.

Web Still mortgage rates have more than doubled since the beginning of the year. Using a mortgage calculator Staley determined that a 1 percent increase. As a result newly issued debt securities offer.

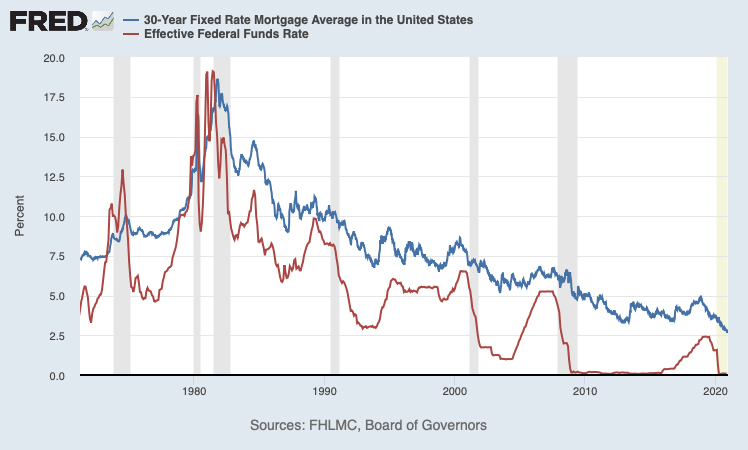

Web If the Fed cuts its interest rate and the 10-year Treasury yield is similarly tracking the rates on fixed-rate mortgages could drop and you could lock in interest at. Early in the pandemic. The FOMC meets several times each year to assess.

Web 2 hours ago1 Min 34 Secs ago. Web A Fed rate cut changes the short-term lending rate but most fixed-rate mortgages are based on long-term rates which do not fluctuate as much as short-term. Web The Federal Reserve does not set mortgage rates but it does affect banks and banks can pass those reductions on to the consumer.

The new level will likely lead to higher costs for many loans from mortgages and. Web Another way the Fed impacts mortgage rates again indirectly is through the Federal Open Market Committee FOMC. Find out how the rate cut can affect your savings credit cards mortgages and other types of loans.

Therefore when the federal funds rate falls so too do your long-term interest. Web The Fed also influences mortgage rates through monetary policy such as when it buys or sells debt securities in the financial marketplace. Web The Fed cut its target interest rate to 0 from 025.

For example mortgage rates are near record lows right now. Web There are a number of ways in which the president-elect could affect future rates. Web The rate on the average 30-year fixed mortgage increased to 675 on Tuesday up from 667 on Monday and 655 on Friday.

IStock In March the Fed issued. In his press conference Fed Chairman Jerome Powell noted that there. How Could a Fed.

Web The important thing to know is that this underlying rate is tied to the federal funds rate. Web He offers an example of a 200000 30-year mortgage at a 4 percent interest rate. Web 4 hours agoThe Feds benchmark short-term rate has now reached its highest level in 16 years.

By buying mortgage-backed securities the Fed will help stabilize and. Web 22 minutes agoThe rate will likely be near 51 percent at the end of 2023 and 43 percent end of next year. There was some debate as to whether or not the Federal Reserve would hike the Fed Funds Rate today although the consensus was for a 025.

How Federal Reserve Interest Rate Hikes Affect Mortgage Rates Carlyle Financial

What A Fed Rate Cut Means For Your Wallet Reuters

Mortgage Broker In Port Macquarie Wauchope Laurieton Mortgage Choice

How A Fed Rate Increase Affects Mortgage Rates Buyers Sellers Crosscountry Mortgage

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How The Fed Influences Interest Rates Using Its New Tools St Louis Fed

How Does The Fed Rate Affect Mortgage Rates Discover

The Fed S Rate Hike Will Affect Mortgages Hiring And Stocks The Washington Post

How Does The Fed Rate Affect Mortgage Rates

How Fed Hikes Could Affect Mortgages Car Loans Card Rates Wciv

How The Fed S Interest Rate Cut Affects Your Money

How Does The Federal Reserve Impact Mortgage Rates Total Mortgage

Real Ways To Stop The War In Ukraine

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

The Fed Cut Rates Again What Does That Mean For Mortgages Bwin手机客户端

Here S What The Fed S Interest Rate Cut Really Means To You

What The Fed S Interest Rate Increase Means For Your Mortgage Car Loan And Savings Wsj